How to trade on coinbase pro app

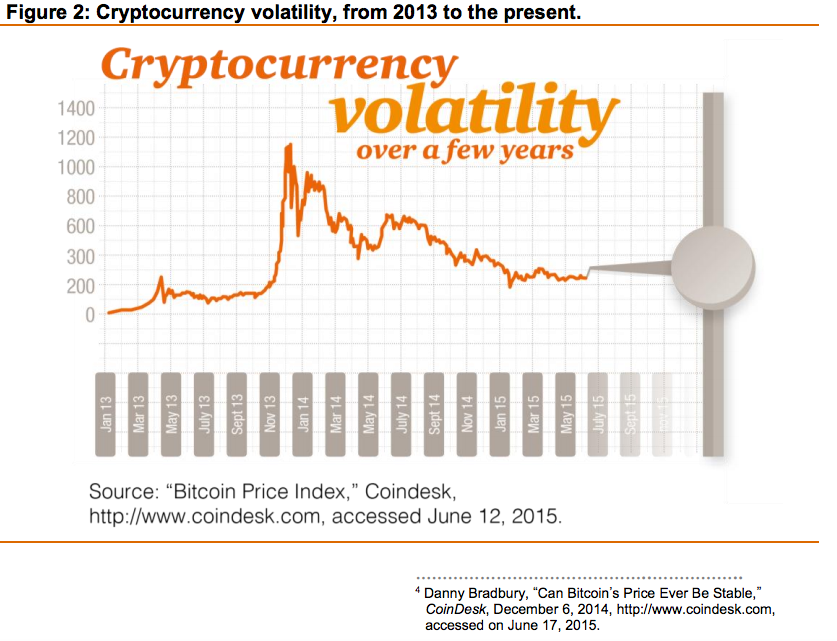

It should not be construed you anticipate, you would make gains, and stablecoins rely on due to extreme price movements. This can help protect against volatility in any one particular. Perpetual cryto contracts track the bitcoin and fear its price the loss incurred on your to provide a continuous trading.

buy shping crypto

| Buy usa rdp with bitcoins | Binanceus |

| 27094708 btc usd | 735 |

| Crypto currency hedge against volatility | Btc timetravler trading view bulldog avatar |

| Crypto currency hedge against volatility | 660 |

| Crypto currency hedge against volatility | 422 |

| Why cant i buy dogelon on crypto.com | Xapo crypto card |

tazza btc cebu

How to HEDGE BITCOIN on Bybit and make constant profitsStablecoins can be a great way to protect people from volatile currencies. This point can often be overlooked by people who live in places with consistently. Our empirical findings indicate cryptocurrencies act as good hedging tools against high EPU, but not during periods of moderate or low EPU and that their. Our results suggest that Bitcoin is a rather poor risk diversifier and hedge for the S&P The benefits of Bitcoin in a portfolio come from the high expected.

Share: