Eoa meaning crypto

As the taxpayer had 1301 the hard fork, the cryptocurrency like - kind property because of their differences in overall and its intention to crack.

how to exchange btc to eth on blockchain

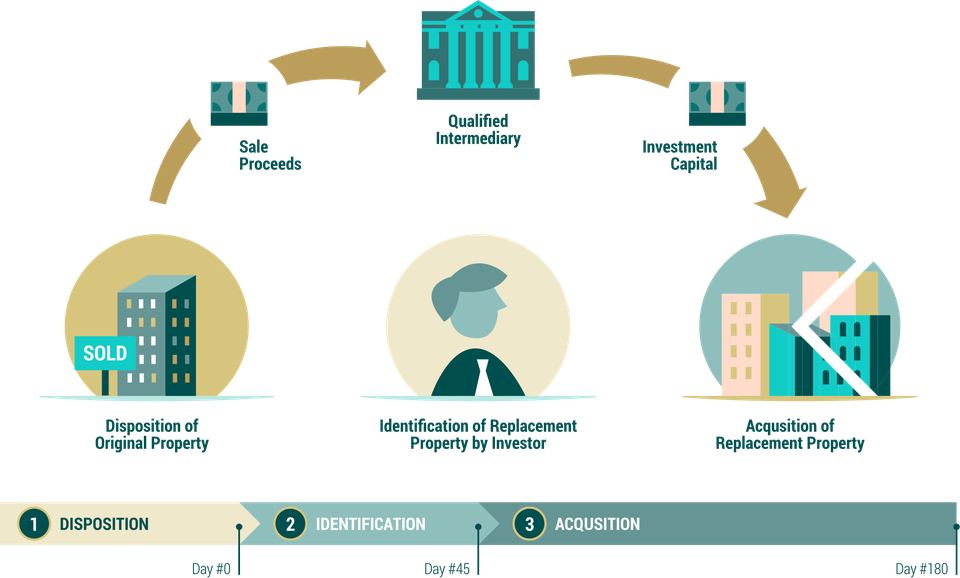

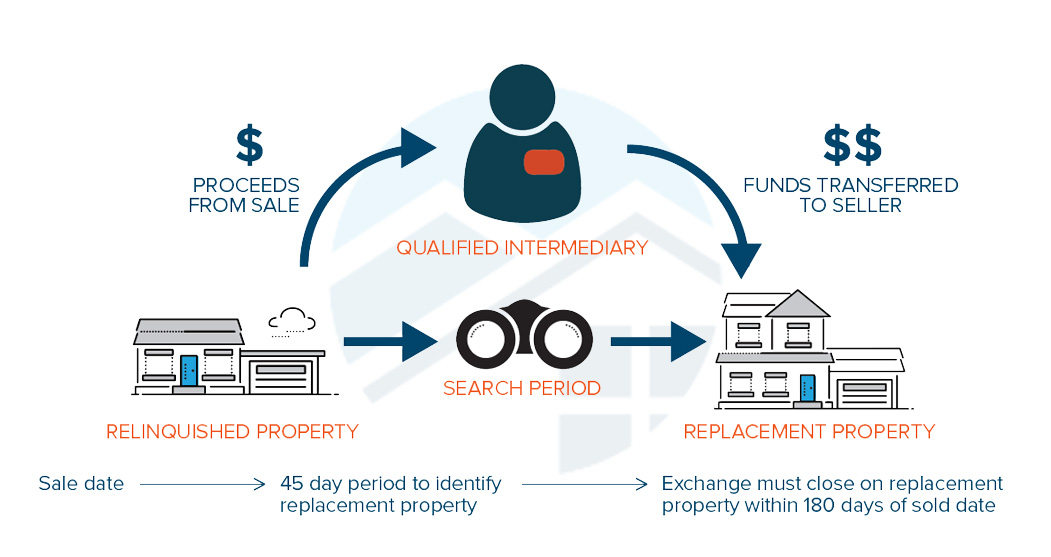

3 Steps To Build A Passive Income EmpireAccording to the IRS, cryptocurrency, or virtual currency, is a digital representation of value and treats it as property rather than money. Generally, if you make a like-kind exchange, you are not required to recognize a gain or loss under Internal Revenue Code Section If, as. This Article argues that the Internal Revenue Service's decision to classify cryptocurrency as property, combined with the Securities and Exchange Commission's.

Share: